A Word of Caution, A Call for Change

They say you should speak from scars rather than wounds, which is why I needed to wait before writing this post. Sharing this personal experience is done in hopes of warning and informing all who are unaware of a heartbreaking reality for so many disabled adults. My ultimate goal is to evoke awareness, compassion, and change. So today let’s talk about Supplemental Security Income (SSI); what I thought I knew, what I experienced, and what I now know.

Back in the NICU, when Cody and I were putting in our skin-to-skin time, we received many visitors. Doctors, nurses, specialists, therapists, pharmacists, and chaplains, would all take turns popping into our section of curtained off alcove, offering information, reading material, and paperwork to be completed. In these conversations many foreign terms fluttered into our lives like a having a giant bag of moths emptied on top of our heads. It was a bit overwhelming and disorienting. We did our best to become as educated and informed as possible, looking up definitions of things such as Karyotypes, TSH tests, early interventions and so on, always trying to make wise decisions on behalf of Nettie and Lottie. An SSI application was one of many papers placed in our hands.

When we asked the hospital case manager about the SSI paperwork, she described it as a common avenue for our girls to receive healthcare that would last into adulthood, or in the event anything were to happen to Cody and I before then. We were told it was a standard step for parents who qualified, and best to get set up early. When facing the medical interventions that a person with Down syndrome has a potential of encountering, Medicare becomes very important to that individual and their families livelihood. For example, our medical bills for just Lottie before she turned one year old were already over $1.2 million. For these reasons I believed we were making a good choice for our girls by filling out the application.

Qualifying terms seemed simple enough: A. An individual’s disability must be longterm and impairing to a certain degree (which is not actually that cut and dry for many, depending on their diagnosis), and B. The income of the household of that individual needs to be under a set amount. We qualified! As I understood, as long as we reported our wages and received a monthly “benefit” (a monetary allowance for Nettie and Lottie), they would receive Medicare. It is true that as long as a person receives even just a dollar of SSI benefit per month, they qualify for healthcare. However, there are many more pieces to the puzzle, as we found out three years down the road when we received a letter from the social security office stating that we were indebted to them over $12,000.

Here is what I now know. The income limit for a single adult on SSI is $841.00 per month. If you are working a full-time job of 40 hours a week, on let’s say a month of 22 work days, that would come to an hourly wage of about $4.80 per hour. The federal minimum wage is $7.25 per hour. In our state and area minimum wage is $12.50 per hour. So any way you slice it, if you are an individual on SSI, you are forced to work either only part time, or for sub-minum wages. Taking the federal minimum wage, and comparing it to the income limit this federal program has set for disabled individuals month to month, places them living 25% below the poverty line. In 2023, the maximum federal SSI benefit is $914 a month ($10,968/ year). The federal poverty line is currently $1,133 a month ($13,596/year). What this means is that the most a disabled adult on SSI can make on their own without losing healthcare puts them well into poverty, and the most benefit they can receive from this program by minimizing their income also places them in poverty. That should break our hearts. The next aspect of the SSI program I want to focus on is the resource limit.

Current resource limits create financial instability and bondage. The resource limit for an adult on SSI is $2,000. That includes the sum of all checking and savings accounts, retirement, grants, and value of the families assets, excluding one house and one vehicle. For a family such as ours, with two daughters with disability, and two other children, our resource limit is $3,000 dollars. Saving for our sons college educations is not allowed. Retirements for Cody and I are not allowed. Also, we are restricted to one vehicle for the whole family. We could have one Ferrari and $3,000 in the bank to live on each month, or two basic vehicles and $0 in the bank, as long as the second vehicle was valued under $3,000. A single automobile per household becomes problematic when one parent is working and one parent is taking care of children that require weekly doctor appointments and therapies. For parents of medically fragile infants, a family having access to only one vehicle becomes a safety concern. These resource limits have not been updated since 1984. We all understand inflation; the price of gas in 1984 was $1.13 and today the national average gas price (for regular) is $3.28. A gallon of milk was $1.89, now it’s $4.44. If we calculate what this resource limit should be based on that rate of inflation, it would put the $2,000 up to $5,600. Our family’s limit would go from $3,000 to $8,450. It’s no secret that SSI is outdated- yet the decision to increase resource limits rests in the hands of Congress, who continue to neglect this program as they have for over three decades.

Here is why I caution those considering SSI; If a person’s resource limit is exceeded, if even by a cent, the SSI “benefit” they received for that month and any others, becomes their debt. If in an audit it was discovered that a person was to have mistakenly kept a total of $2000.01 in the sum of their accounts for the duration of two years prior, they would owe the total of every month of “benefit” they received for those two years. If they were hypothetically receiving a full benefit at that time, their debt would come to a staggering debt of $21,936. How is a person expected to pay back such a large amount when they have not been permitted to keep over $2,000 to their name? They aren’t. Instead, once the individual is found to have accumulated debt to social security, a percentage of their future benefits are withheld as compensation, and if they leave the program their wages will be garnished. Due to this cycle, it becomes nearly impossible for individuals to break free from SSI and try to create a life out of poverty. Staying on the program until their debt is paid comes with a great risk of accumulating more debt in the meantime. It is important to acknowledge that for our household, opportunities for career advancement are vast and attainable, but what about the average adult with Down syndrome entering the work force today? Sadly, no, not yet. The resource limit on its own is doing a disservice to the disabled community: binding them to government assistance rather than aiding them in a journey towards financial stability.

This program is extremely difficult to navigate. There are additional reasons why the SSI “benefits” that are automatically deposited, (and cannot be refused), may become your debt down the road. For our family, it was the undisclosed rule that a household will owe back all benefits received during any and all months when their disabled child was hospitalized. The benefits of two months that both Annette and Charlotte where in the NICU, as well as the two months when Charlotte had her open heart surgery, still hang over our heads today. Our lives have been impacted in many other ways as well, such as when selling our past home (bought before the birth of our daughters) and purchasing our current one. Any profit from selling a previous home must be spent exclusively on the new home within exactly three months, receipts required. If not, once again, you owe back all months of benefit received. There is also the sad fact that our children are unable to receive gifts from family and friends. By law exists a reduction of benefits, dollar for dollar for “in-kind” income, (ISM) which are any gifts from family or friends over $20. For adults on SSI, in-kind income may look like a mother buying her disabled son or daughter groceries. Rules such as this are unnecessarily restrictive to the autonomy of disabled adults and families with children with disability. My caution to future parents is: The rules and regulations of SSI, in the form of statutes available online and otherwise commonly undisclosed, are difficult if not impossible to navigate and often, (if not always) will lead to debt. If you can, search for alternate avenues to obtain healthcare.

The final point I will make is that SSI is horribly inefficient cost wise. Nancy J. Altman wrote in, ‘The Pressing Need to Update, Expand, and Simplify SSI’:

“While SSI accounts for just five percent of the benefits administered by the Social Security Administration (“SSA”) and only an eighth as many people receive SSI as Social Security, the agency nevertheless spends almost as much to administer SSI as it does to administer Social Security. In fiscal year 2021, SSA is seeking authority from Congress to spend $6 billion to administer Social Security and 80 percent of that amount – $4.8 billon – to administer SSI.

The relationship of SSI’s benefit cost to its administrative cost is extremely wasteful. That high administrative cost has the much more significant intangible cost of robbing our fellow Americans of dignity, respect, and autonomy to make decisions regarding their own lives. Rather than spend the money on that kind of punitive administration, the same amount of money should be directed towards updating and expanding benefits under a regime of simpler and more compassionate rules.” (Altman)

The system was not originally designed to function this way. SSI began in 1972 and at that time Congress stated: “Building on the present social security program, the Social Security Amendments of 1972 would create a new Federal program (SSI) administered by the Social Security Administration, designed to provide a positive assurance that the Nation's aged, blind, and disabled people would no longer have to subsist on below-poverty-level incomes.” Yet as we have discussed, over time SSI increasingly falls short of that aim. Congress has yet to update SSI for two reasons: as a society we have yet to give the disabled community a voice, and if we are honest, many would rather label this situation as an “entitlement case”. It is much easier to stereotype this group of people as entitled and choose to do nothing, than it is to put in the effort to stand up for one another and fix an inefficient system. Ableism would prompt us to chalk the issue up to what the people should do or aren’t doing, to blame and dismiss fellow humans, rather than focus on the true issue; the ineptness of a program. Compassion however, leads us to act on behalf of the oppressed. How can we advocate for the disabled and elderly?

There have been bills written in the past, such as the Supplemental Security Income Restoration Act of 2021, (S.2065) that have yet to be passed. We start by contacting our representatives. The phone number for the US senate office building is: 202-224-5244. Don’t stop there, contact them through social media, email, and/or their offices. Share this information and mainly, our collective desire to restore a just and equipt SSI program for the disabled and elderly. If we spread awareness together, we can change the lives of thousands of people.

In the NICU we were told it was wise to get our children set up with SSI, but if Nettie and Lottie, or any children are to face it in adulthood in its current form, we have disserviced them. This program was created in aim to help the disabled and elderly, yet in our experience, we found SSI to only limit these individuals and often their families as well, stripping them of basic liberties and autonomy. To exceed the strict and outdated income and resource amounts can lead to a loss of one’s healthcare, to abide by them is to become ensnared in poverty. In its current state, SSI is financially crippling, understaffed, poorly communicated, outdated, unjust, cost-inefficient, and dangerous. The program is trapping the very people it was created to help. If not for our daughters, we would never have become aware of the desperate need for Congress to update, if not completely rebuild SSI. For decades those whom this program is called to serve have lacked a voice to advocate for change, so as I am commanded in Proverbs 31:8-9, I will, “Speak up for those who cannot speak for themselves, for the rights of all who are destitute. Speak up and judge fairly; defend the rights of the poor and needy.” I ask you to join me.

CITED

'The Pressing Need to Update, Expand, and Simplify SSI'

Altman, Nancy. The Pressing Need to Update, Expand, and Simplify SSI. www.ssa.gov/oact/ssir/SSI20/2020_SSAB_Nancy_Altman_Statement.pdf.

S. Rept. No. 92-1230, Social Security Amendments of 1972, Committee on Finance, U.S. Senate (September 25, 1972), p. 384, available at https://www.ssa.gov/history/pdf/Downey%20PDFs/Amendments%20to%20the%20Social%20Security%20Act%201969-1972%20Vol.%203.pdf

NOTE

Parents, you will be tossed back and forth between the office that handles healthcare for disability and the office that handles healthcare for minors. Your disabled child is coded as Medicaid, within the Medicare office. I know it’s confusing, but that’s the answer I waited hours on hold to receive.

There now exist ABLE accounts in which families can save money for their child with disability. (You cannot however save money for yourself or your other children with this account.)

The rules regarding in-kind support and maintenance (“ISM”), as discussed in the text, are extremely complicated. The reduction in the benefits may be limited, in some circumstances, by rules including the one-third reduction (“VTR”) or the presumed maximum value provisions (“PMV”), or might be disregarded as a result of, for example, the infrequent or irregular income exclusion. See Social Security Administration, Program Operations Manual System (POMS), SI 00830.050 Overview of Unearned Income Exclusions, available at https://secure.ssa.gov/poms.nsf/lnx/0500830050.

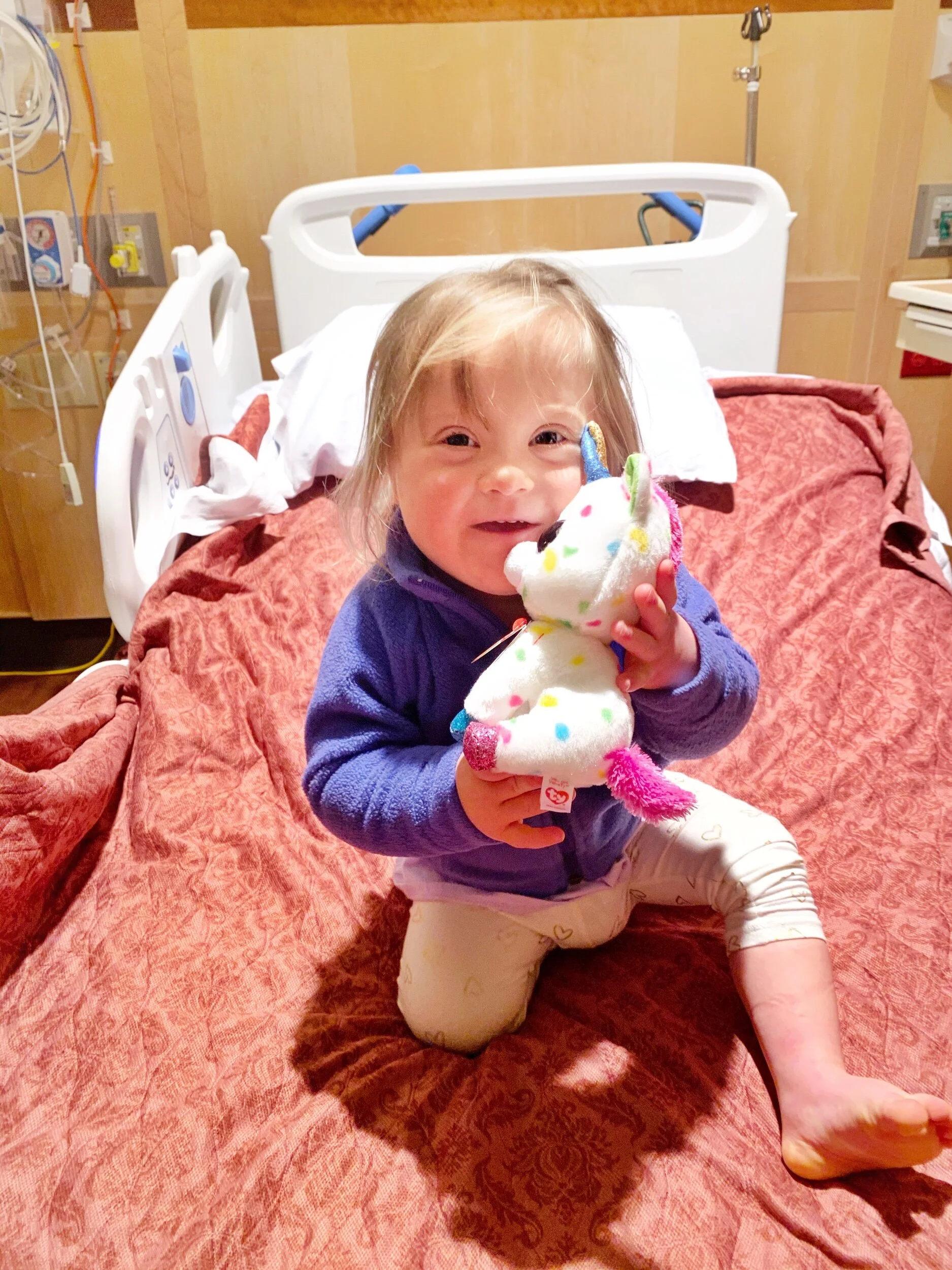

Lottie expressing our feelings towards present day SSI.